Global Context: Rising Interest Rates

The world is preparing for another economic slowdown.

Following the European Central Bank’s decision to raise interest rates from 0.5% to 1.25%, most European banks have increased the cost of their mortgage products.

Outside the EU, other states face similar challenges. In the United Kingdom, the economic policies adopted under Liz Truss’s government — including significant tax cuts — led to the depreciation of the British pound and rising national debt.

As a result, many UK banks have withdrawn low-interest mortgage offers to curb demand and contain inflation.

For British citizens, this has meant more expensive loans and tighter lending conditions at home.

(Reference: European Central Bank – Monetary Policy Decisions)

A Strategic Alternative: Mortgages in the Balearic Islands

While the UK market tightens, the Spanish mortgage market remains stable.

Interest rate caps and competition among banks in Spain have kept mortgage costs under control — the maximum variation currently sits around 3%.

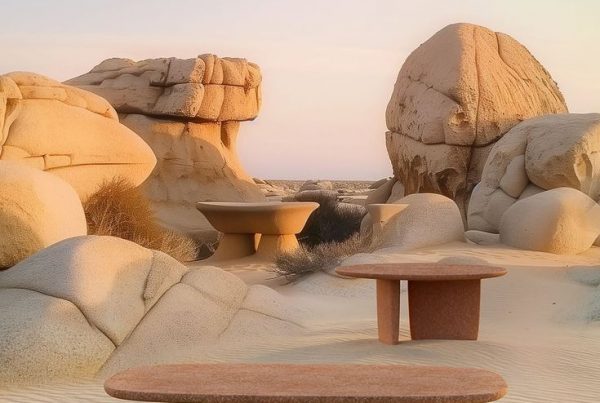

This stability makes the Balearic Islands an attractive alternative for British citizens looking to buy property abroad.

(See also: Frau Legal – Balearic Property Market Insights)

Why Choose a Mortgage in the Balearic Islands

- Favourable Interest Rates – Spanish lenders continue to offer competitive fixed and variable mortgages, even in a context of rising European rates.

- Legal Security – Spanish mortgage law, under Law 5/2019, of Real Estate Credit Contracts, ensures transparency and consumer protection.

- Strong Market Performance – As noted in our previous article on real estate profitability in Mallorca, property values in the Balearic Islands continue to rise steadily, even during global downturns.

- Lifestyle and Stability – Investing in Mallorca, Ibiza, Men